Paul Krugman, a Princeton Economics Professor and New York Times columnist, serves as the chief gaslighter for the Biden administration.

Krugman, the Economics Nobel Prize winner in 2008, is as liberal as they come. Unlike other Left-leaning economists, he is not afraid of the liberal label. His New York Times bestseller, written after winning the Nobel Prize, is called "The Conscience of a Liberal." Michael Tomasky of the New York Review of Books said Krugman's work was "the most consistent and courageous―and unapologetic―liberal partisan in American journalism."

Being liberal is one thing, but being consistently wrong by ignoring facts on the ground is another. Krugman, a staunch Biden supporter, leverages his pedigree and perch to paint a rosy picture of the Biden economy, attempting to promote the administration's position that all is hunky-dory.

Krugman recently tweeted:

Persuadable people have noticed the good economy, and Biden should go ahead and claim credit.

Credit for what? 64% of Americans live paycheck-to-paycheck, and nearly 25% have $0 for an emergency. More Americans are working a second job to make ends meet.

In another tweet, Krugman states:

Recent economic news has been extremely good. But there's a strange meme among some D consultants that Biden shouldn't boast about it because it seems out of touch — that people aren't feeling the good economy. But they are!

Good economy? 58% of Americans feel they are worse off than four years ago. 17.3% Bidenflation and the Fed's eleven rate hikes to reduce inflation have made housing unaffordable for many people and caused displacements.

Krugman's periodic statements indicate that he either chooses to remain uninformed or outright ignores the realities on the street. Given his stature as a Nobel Laureate and economics expert, engaging with a few regular Americans and displaying a sincere interest in their viewpoints could improve the accuracy of his pronouncements. Alternatively, he could speak to his graduating students, who would likely enlighten him about their struggles and job market realities.

This partisan disease just doesn't afflict Krugman. In September 2021, 17 Nobel Prize winners in economics signed an open letter supporting Biden's Build Back Better legislation (BBB). Contrary to common wisdom, they vouched that the additional $2.4 trillion over the already approved $4.1 trillion in deficit spending would not increase price pressure, causing inflation. The BBB proposals failed and saved the economy thanks to the brilliant leadership in December 2021 by West Virginia Sen. Joe Manchin, a non-economist.

Still, the CPI rate hit a record 9.1% in June 2022, a level not seen since the Jimmy Carter years of the late 1970s. Thanks to Janet Yellen, Krugman, and co., America is paying over $1 trillion to service the national debt, which has already reached $34 trillion and an unbelievable 127% debt-to-GDP ratio. The U.S. is the most indebted nation in the world. Imagine what would have happened had the BBB legislation passed, and the country was flooded with all that borrowed cash. We would be looking at the Fed tightening even more than it has, well into the next several years, plunging America into a deep recession.

No wonder 'Bidenomics' turned out to be a big brand blunder. President Biden, who listens to folks like Krugman, makes tall claims that do not pass the smell test. Pocketbook economics is different from wonkish, esoteric policy stuff. Americans realize the truth when filling their gas tanks or leaving a grocery store.

When Krugman makes claims on broad economic topics, we take them with a pinch of salt. The material we present is based on our research and data, essential tools of the economics profession that Krugman and his friends deliberately misrepresent. Our work depicts an entirely different picture of the economic struggle in Biden's America.

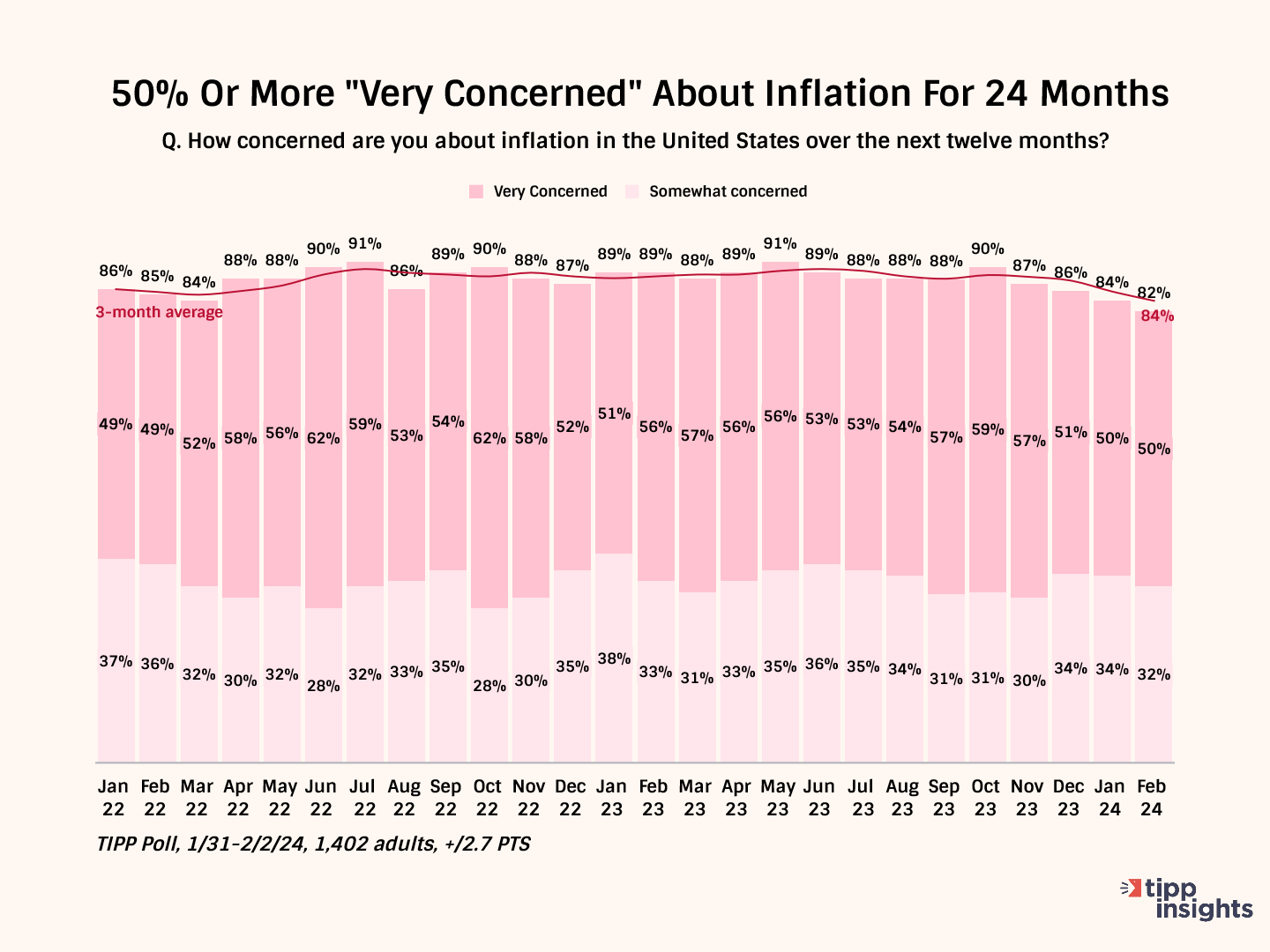

Inflation Concerns

Inflation is a nightmare for Americans. With stagnant wages that have failed to keep pace with price increases, Americans have not been able to adjust to the higher cost of living. Average hourly earnings for all employees dropped 2.0% to $11.16 in January from $11.39 in January 2021, when Biden assumed office.

Since January 2021, prices have increased by 17.3%, while real wages have declined by 2.0%, i.e., people now need 19.3% more income than they had then to maintain their living standards. According to some estimates, Americans need an extra $11,400 a year to make ends meet.

Professor Krugman, this chart would be different if the inflation problem were over, as you say. Please note that the share of those very concerned has stayed above 50% for 24 months.

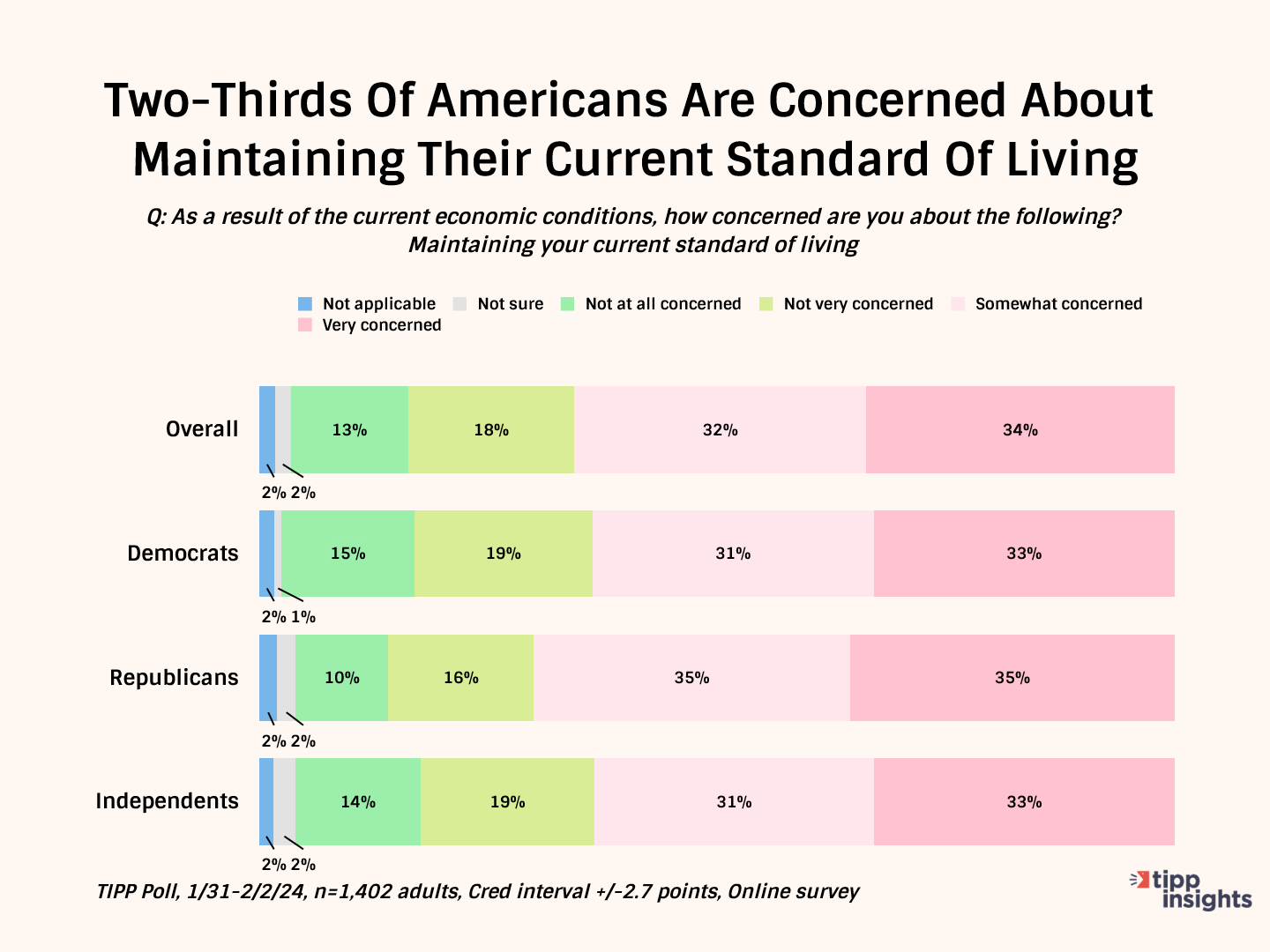

Living Standards

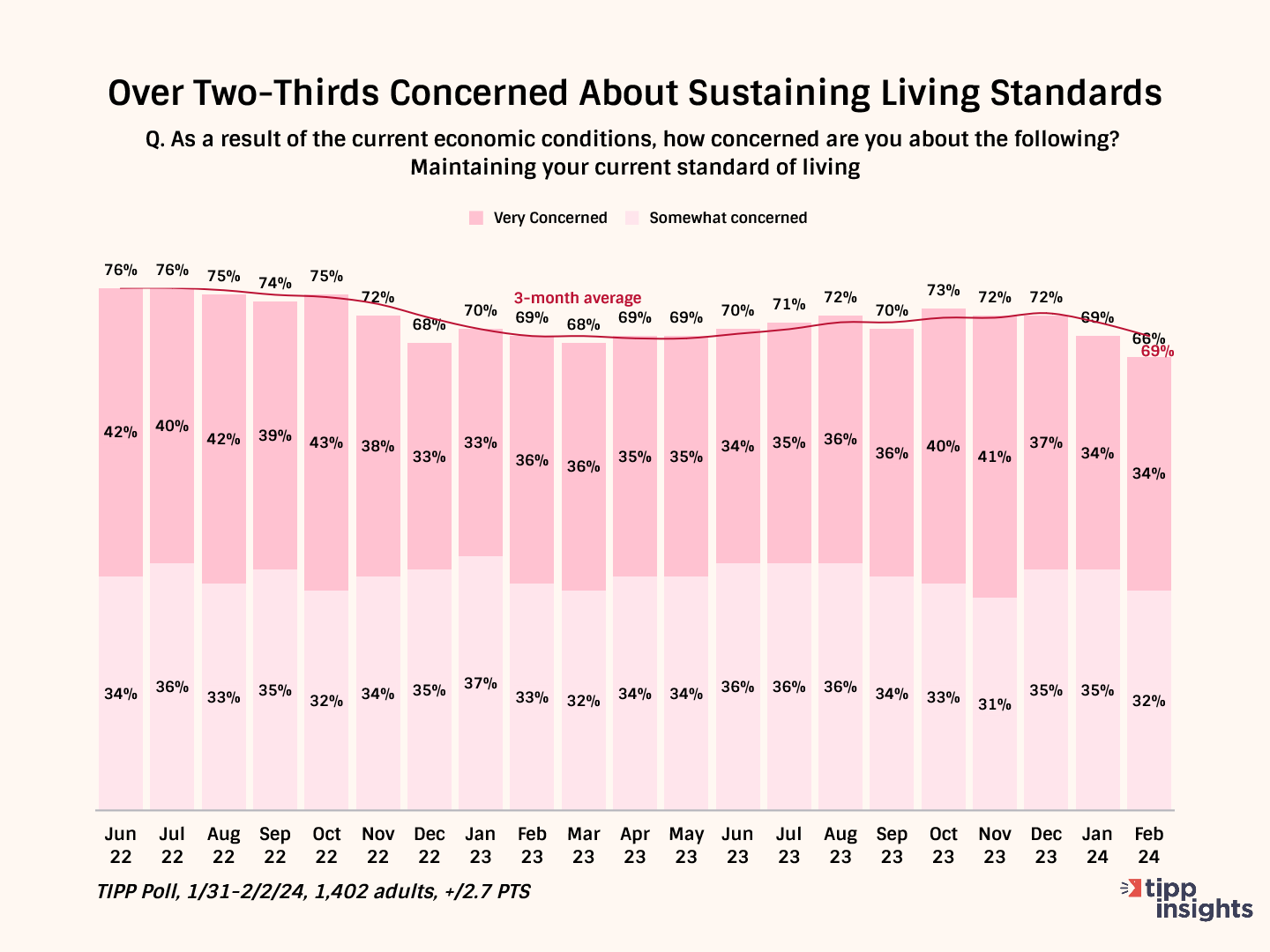

Even though the year-over-year inflation rate has come down from its peak of 9.1% in June 2022 to 3.1% in January 2024, two-thirds are still concerned about maintaining their living standards.

Note that the concern is across the board: 64% of Democrats, 70% of Republicans, and 64% of independents.

The chart below tracks concerns from June 2022. Notably, the share of those concerned persists in the 66% to 76% range, although the inflation rate has dropped considerably, showing that a significant share of Americans are still struggling.

Utility Bills

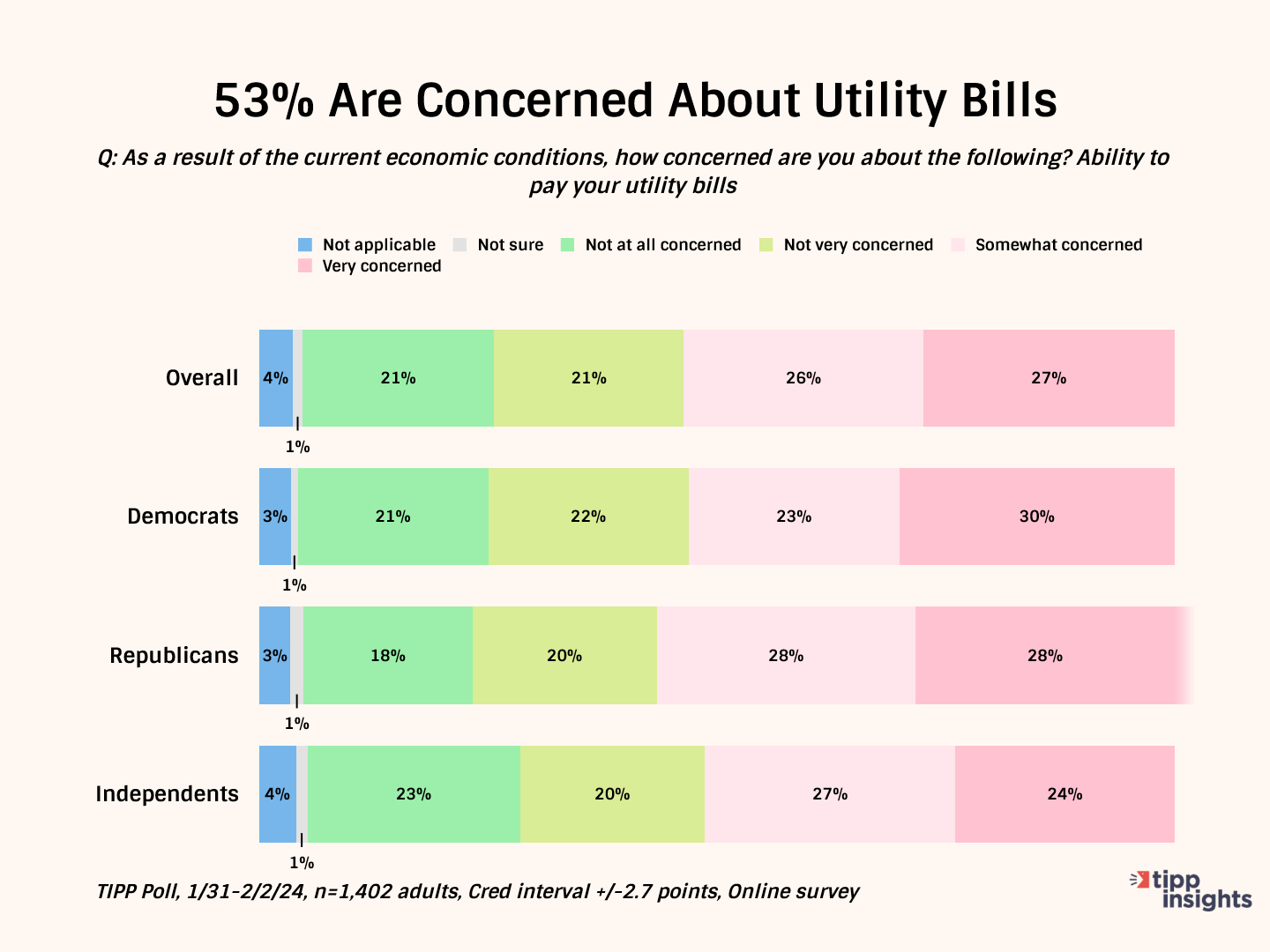

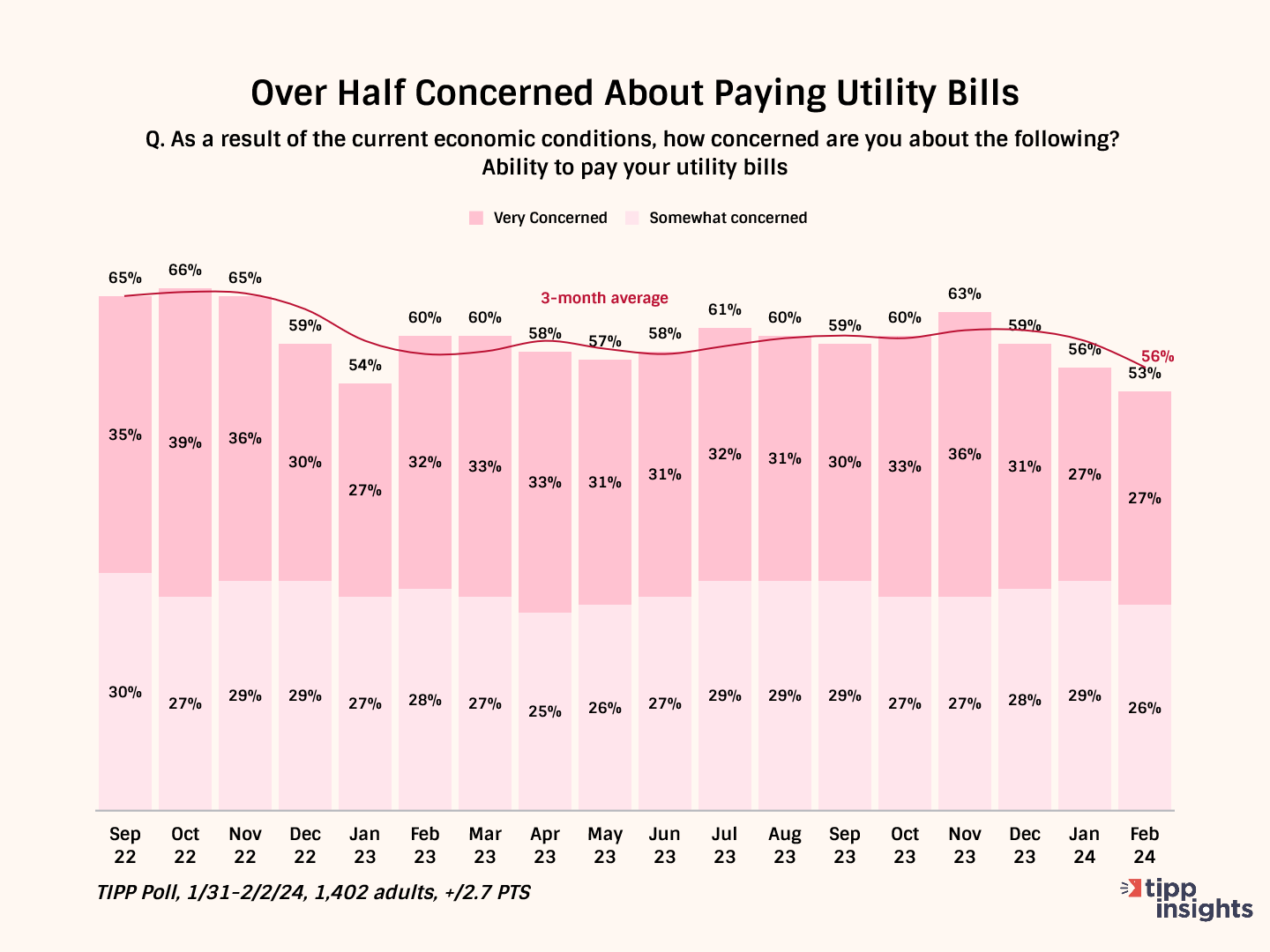

A majority of Americans (53%) in the latest TIPP Poll are concerned about paying their utility bills. Here again, it is not driven by party affiliation. Fifty-three percent of Democrats, 56% of Republicans, and 51% of independents share the concern.

Contrary to the notion of a good economy, the concerns persist in the 53% to 65% range.

Another recent survey by HOP Energy highlighted Americans' struggles with paying their utility bills, revealing that one in five Americans faces difficulty paying their utility bills on time. Additionally, nearly one in eight (12%) have experienced a utility shut-off due to non-payment.

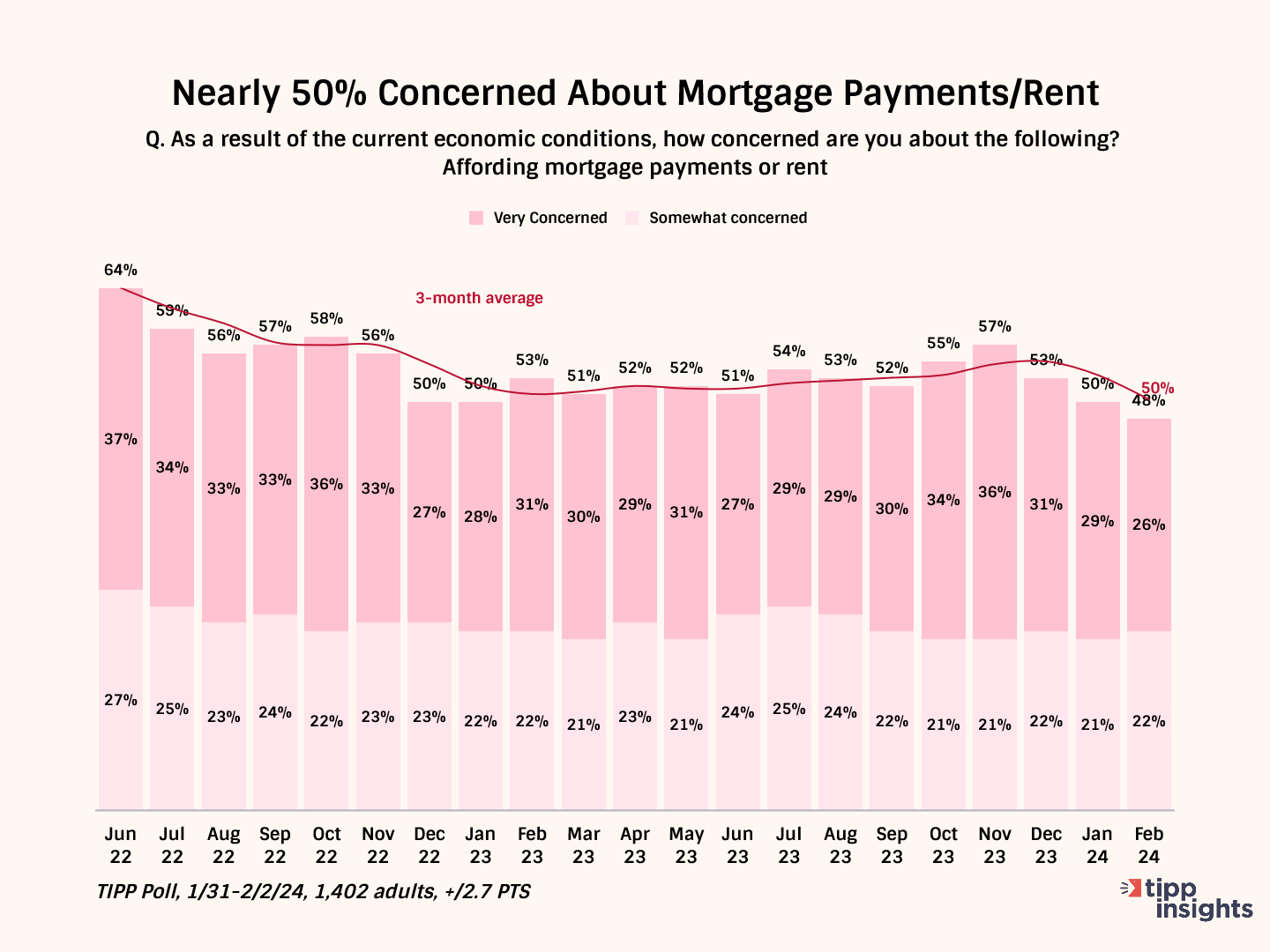

Mortgage/Rent Payments

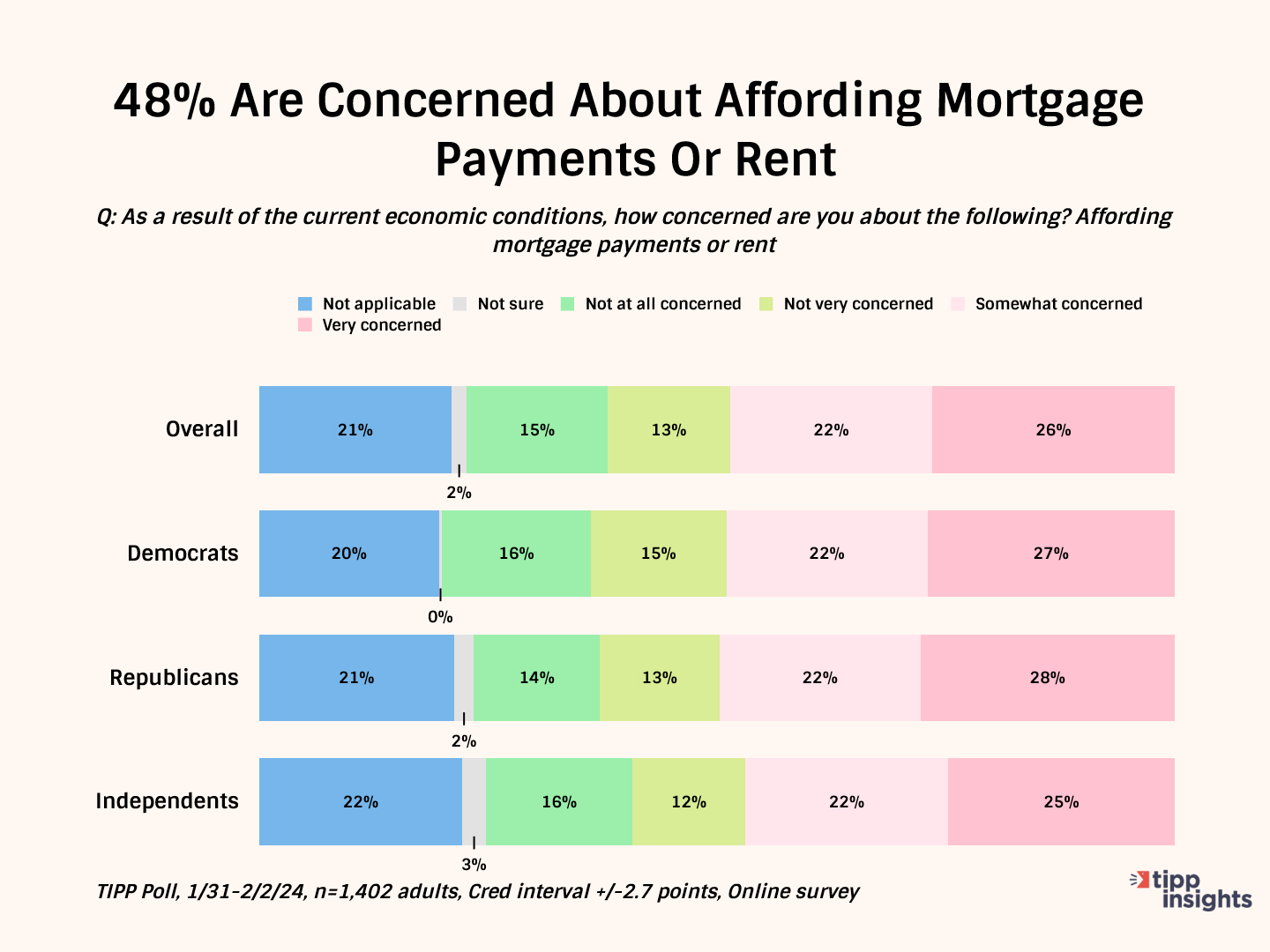

Nearly half (48%), according to the latest TIPP Poll, are concerned about making mortgage payments or rent. Here again, note that the concern is shared by all party affiliations – 49% of Democrats, 50% of Republicans, and 47% of independents.

The chart below tracks the concern since June 2022. Notice that there is no significant decrease, and the share concerned hovers in the 48%-55% range, which is inconsistent with the idea of a good economy.

Recent data from the Transunion credit reporting agency reveals that 1.3% of mortgages are currently 60 days past due, with approximately 1,092,000 Americans falling into this category. This marks a 16% increase from the previous year.

People in the $45,000 and $74,999 per year income bracket took the biggest hit from rising rents. According to a recent Harvard study, 41% of their paycheck, on average, went toward rent and utilities.

The mortgage/rent situation is displacing individuals and families and increasing homelessness. Recent government data also supports our survey results. The latest 2023 Annual Homeless Assessment Report (AHAR) from the U.S. Department of Housing and Urban Development (HUD) estimated that 653,100 people experienced homelessness on a single night in 2023, marking a 12% increase of 70,650 individuals from 2022. HUD also noted that the 2023 count was the highest since they began tracking the situation in 2007.

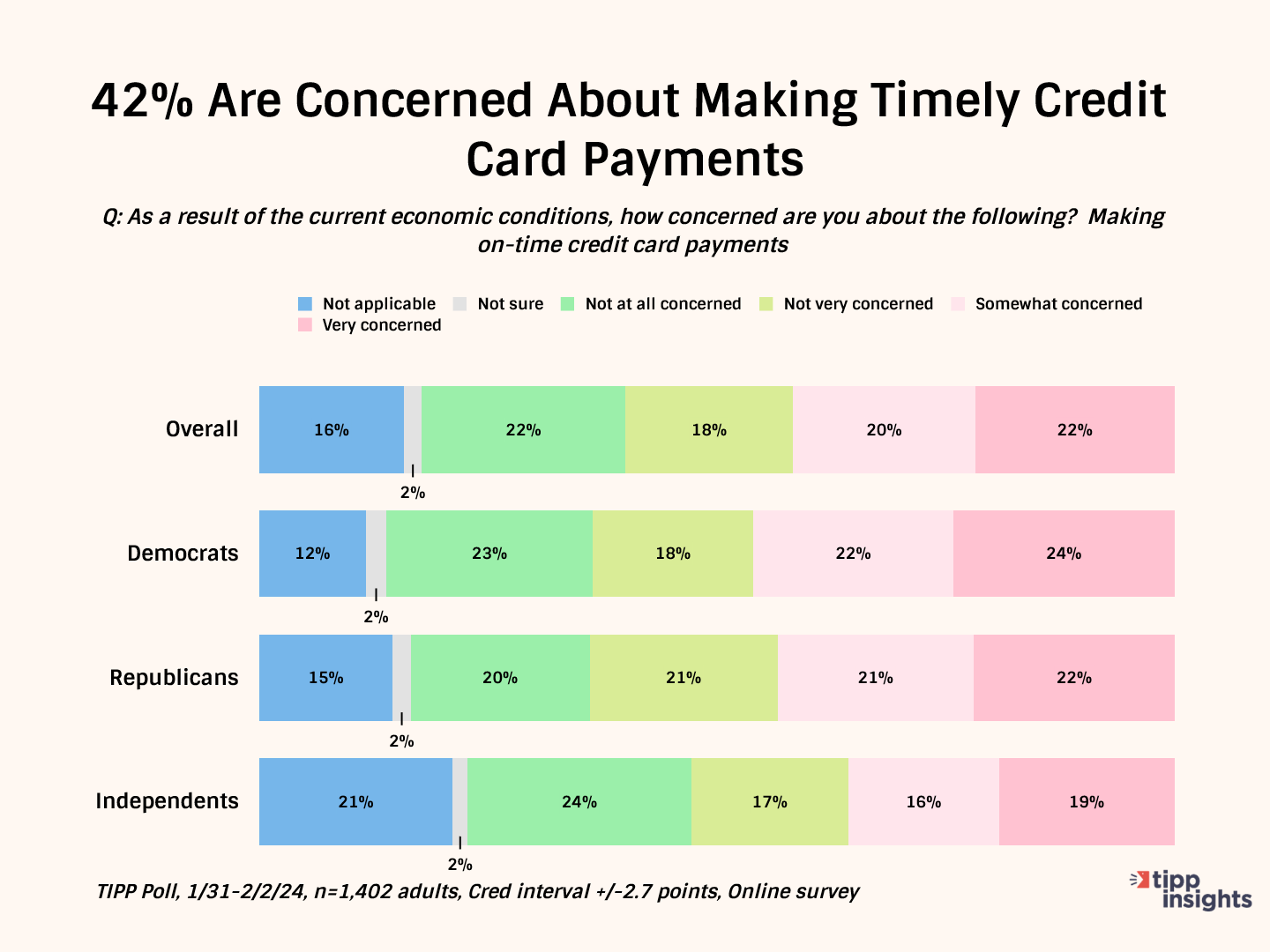

Credit Card Debt

Over four in ten (42%) respondents in the latest TIPP Poll are concerned about making timely credit card payments. One in five (22%) is very concerned, and another fifth (20%) is somewhat concerned.

Here again, it is across the board by 46% of Democrats, 43% of Republicans, and 35% of independents.

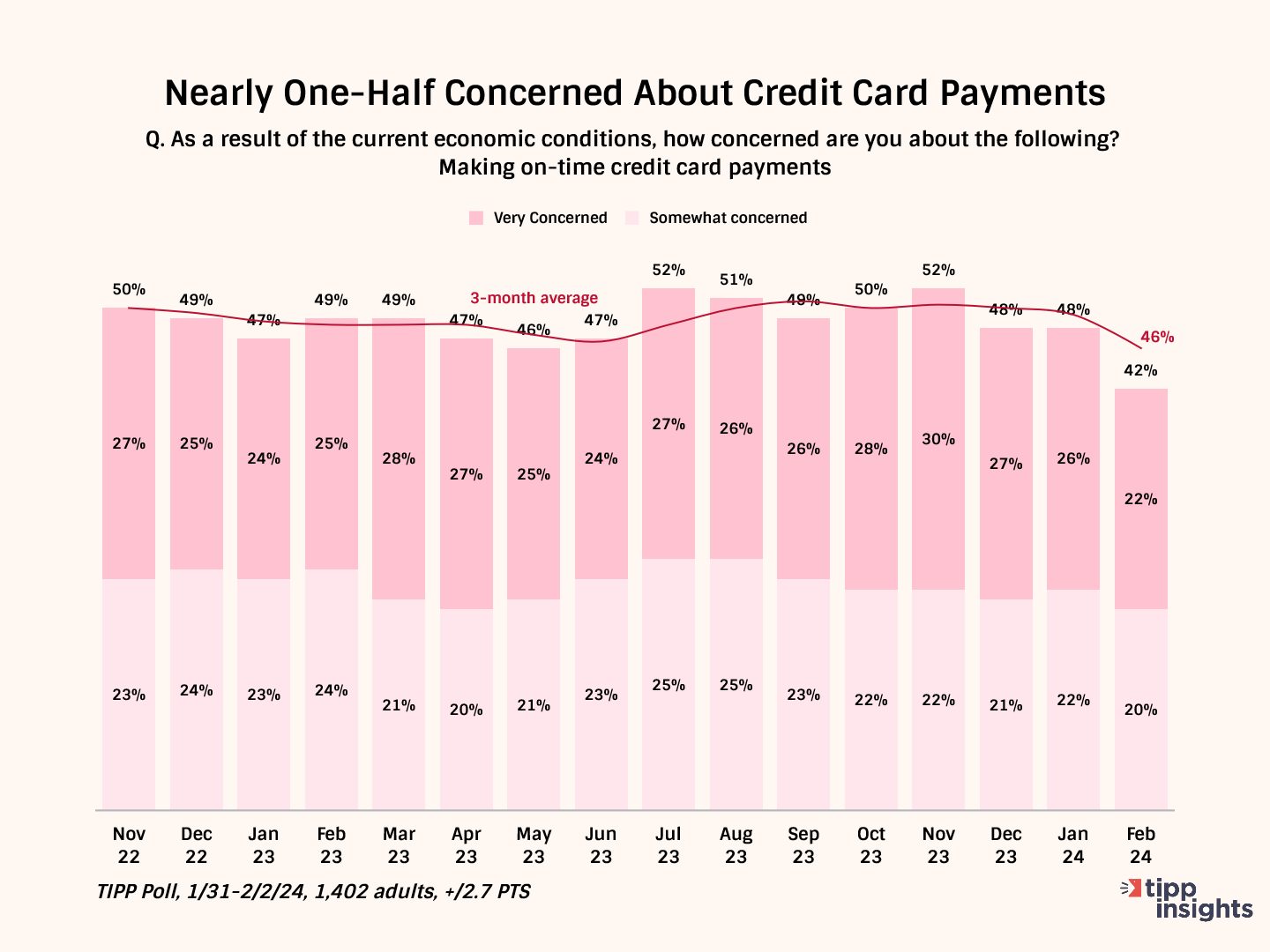

The chart below shows our monthly tracking. Notably, 40% to 50% of Americans have shared the concern over the past year.

According to the Federal Reserve Bank of New York’s latest Household Debt and Credit Report, Americans held $1.13 trillion in credit card debt as of December. That’s a historic high.

Meanwhile, our data echoes a CNBC story on Thursday titled:

Nearly 1 in 4 Americans with debt are putting less money toward credit card payments: ‘People are really struggling.’

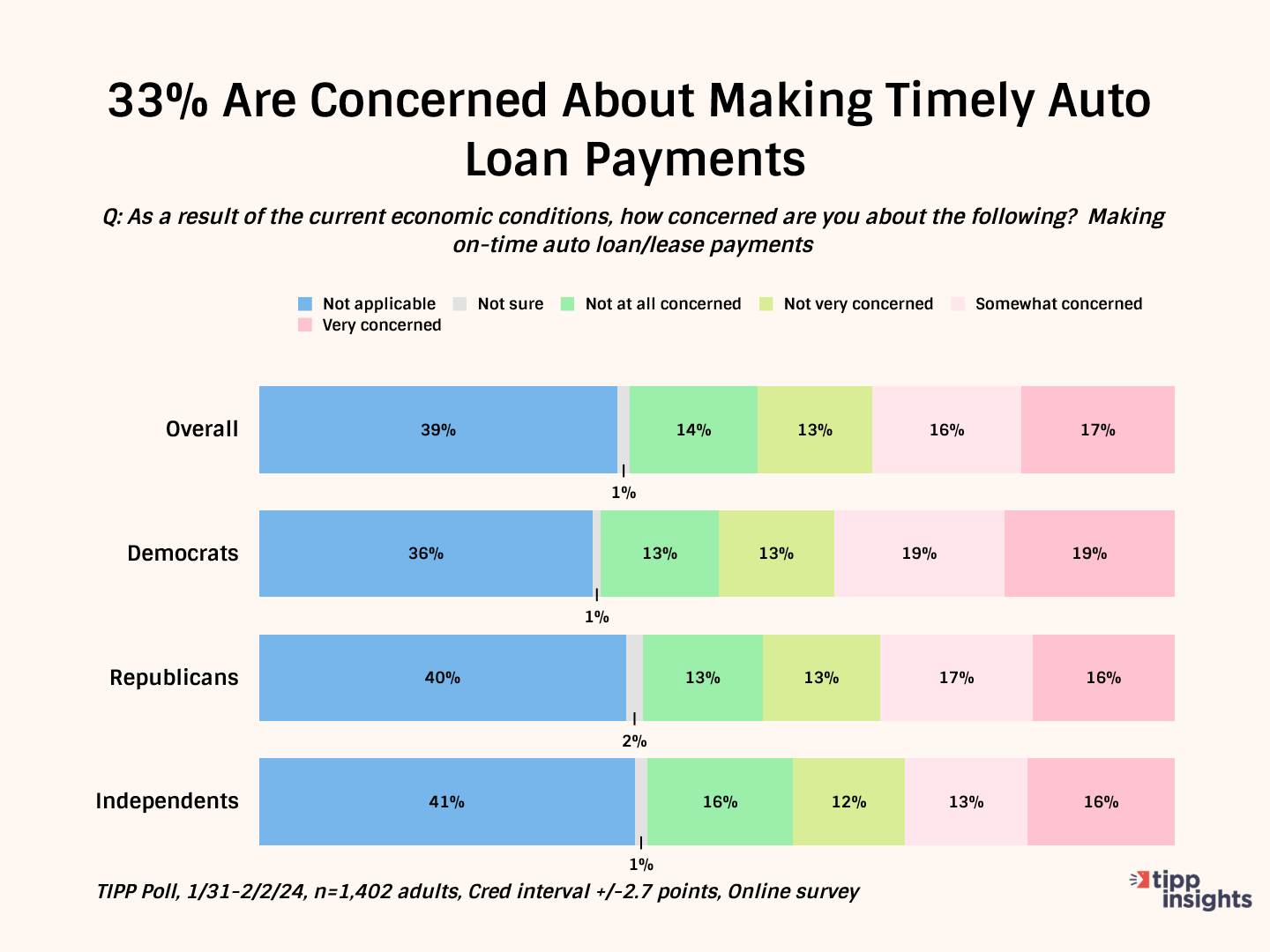

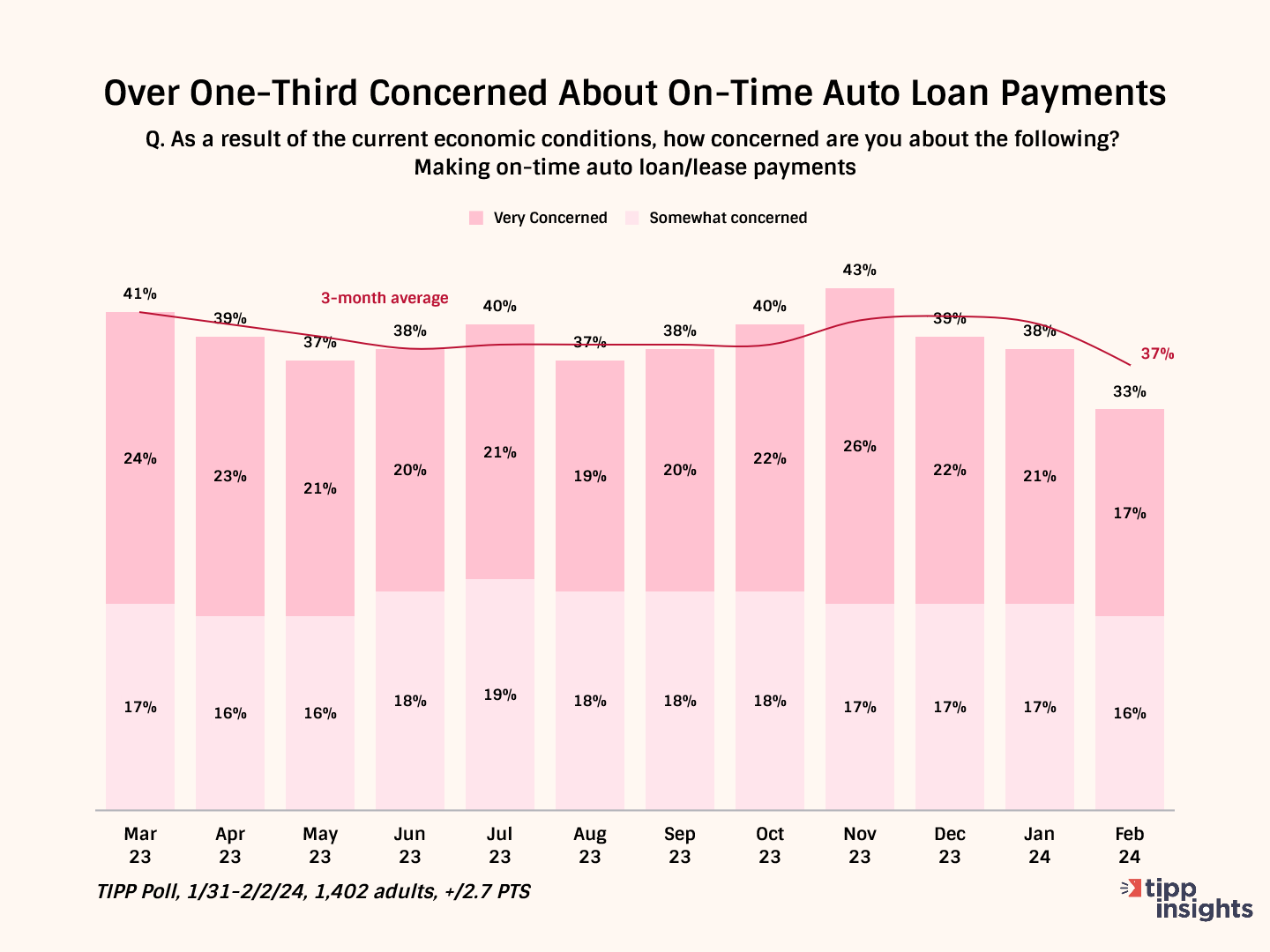

Auto Loan Payments

Many Americans struggle to make timely auto loan/lease payments.

One-third of TIPP Poll respondents are concerned about making timely auto loan or lease payments. One in six (17%) are very concerned, and another 16% are somewhat concerned. The share of worried among Democrats is 38%, Republicans 33%, and independents 29%.

The chart below tracks the share of concerned Americans since March 2023. The share has remained steady in the 33% to 43% range.

According to recent news stories, car loan delinquency rates have climbed to 7.69%, the highest level since 2010.

The increase in delinquency rate is due to multiple reasons. First, the average cost of a new car now is $48,759. Second, the average interest rate for a new car loan is 7.8%, whereas for a used car, it is 8.6%. With high car prices and interest rates, one in six (17.1%) make car payments of over $1,000 a month.

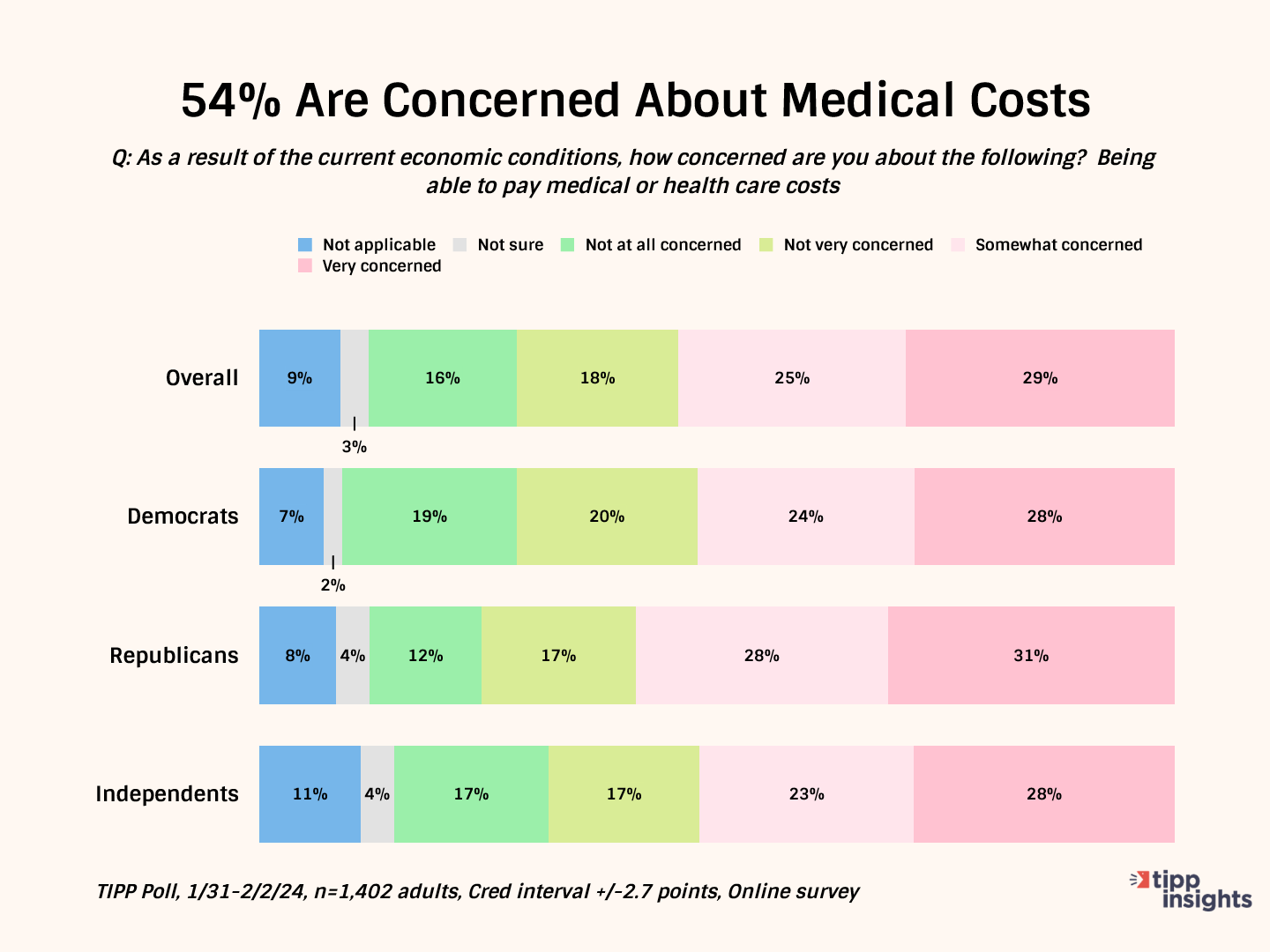

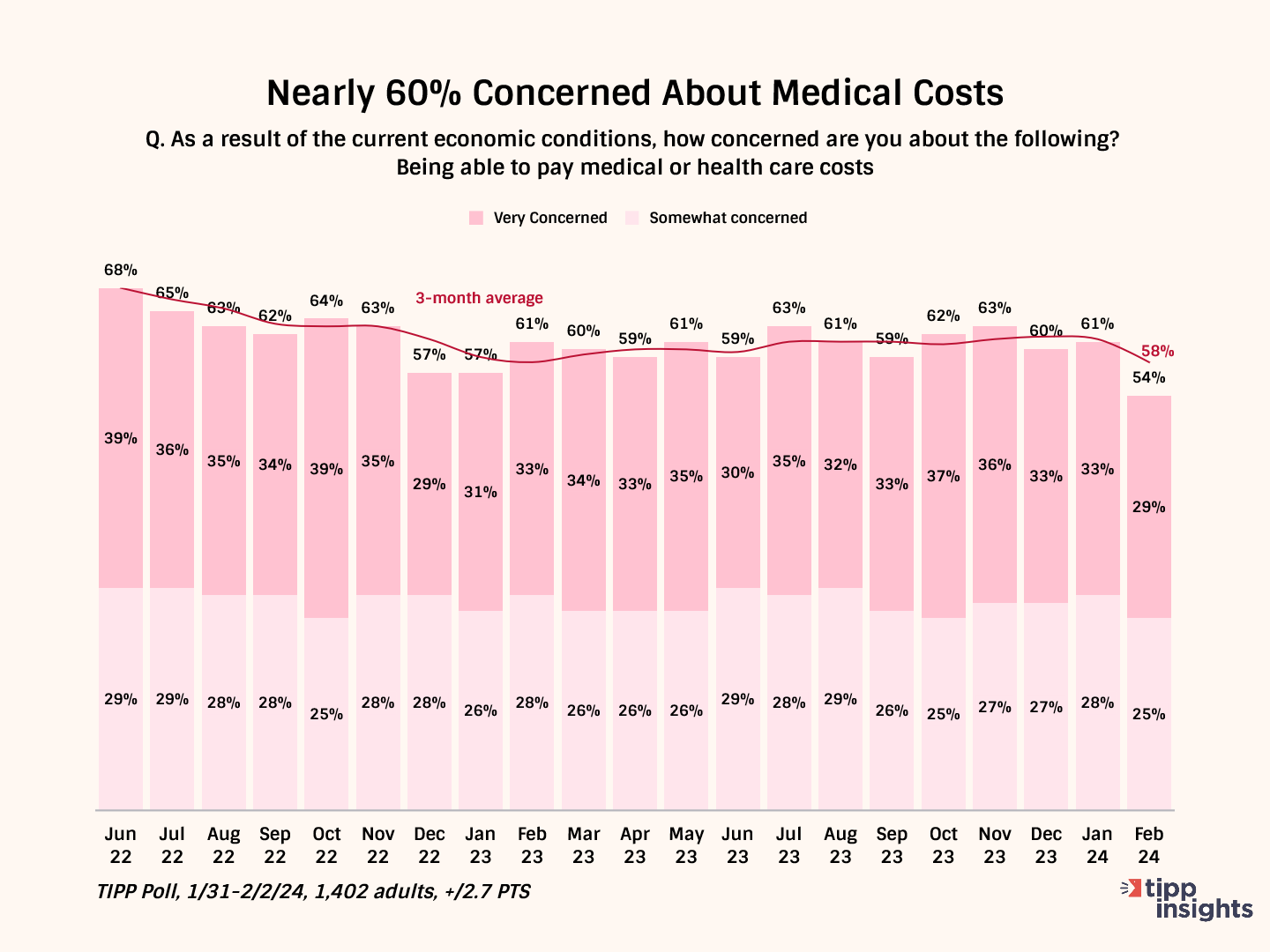

Medical Costs

Most (54%) are concerned about paying for medical or health care costs, with 29% very concerned and another 25% somewhat concerned. 52% of Democrats, 59% of Republicans, and 51% of independents share the concern.

Interestingly, the concern decreases with age:

- 67% for age 18-24

- 60% for age 25-44

- 54% for age 45-64, and

- 39% for age 65+

The chart below shows our monthly tracking since June 2022. Note that over the past year, the data has moved in a close range from 54% to 63%.

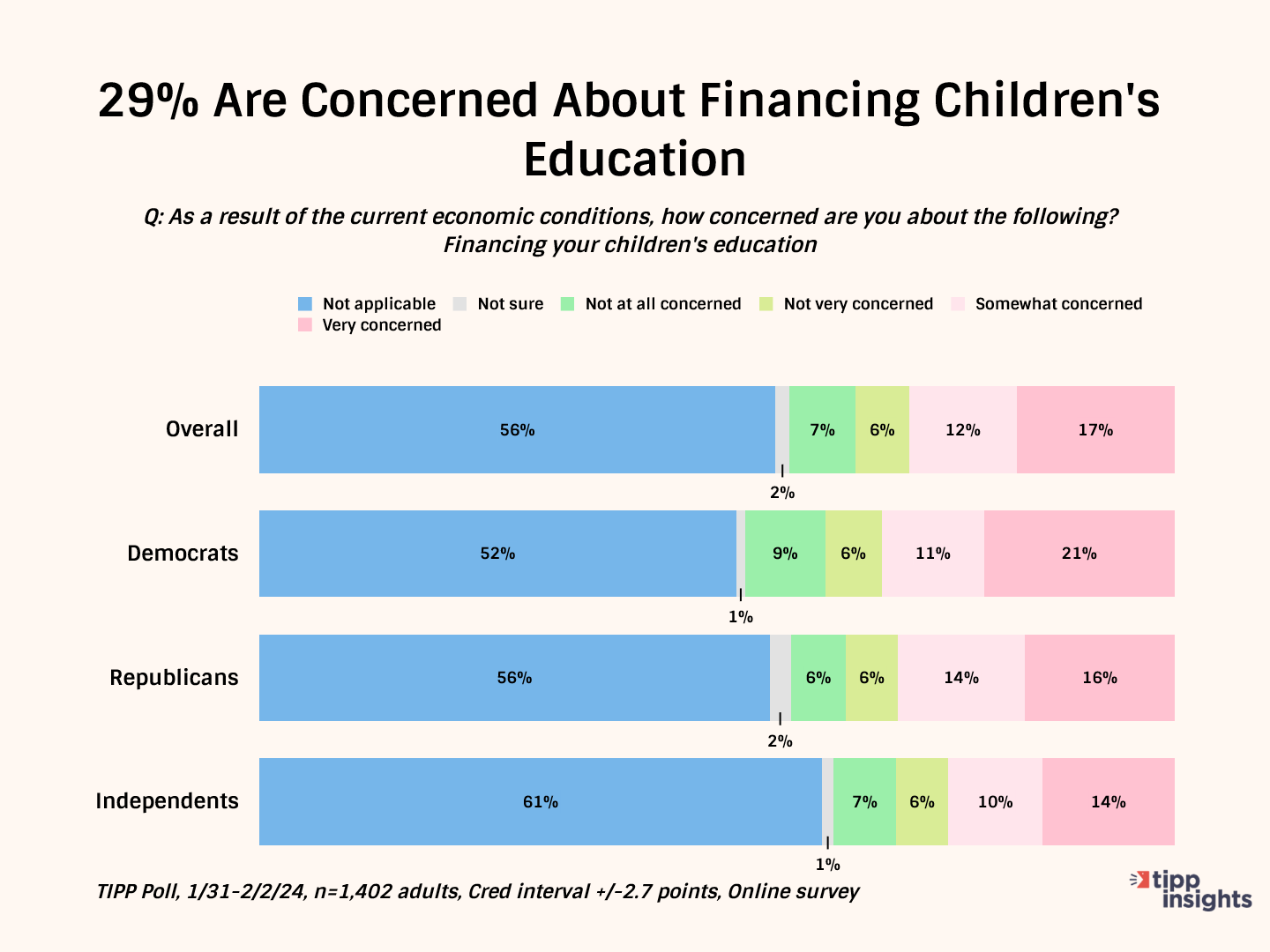

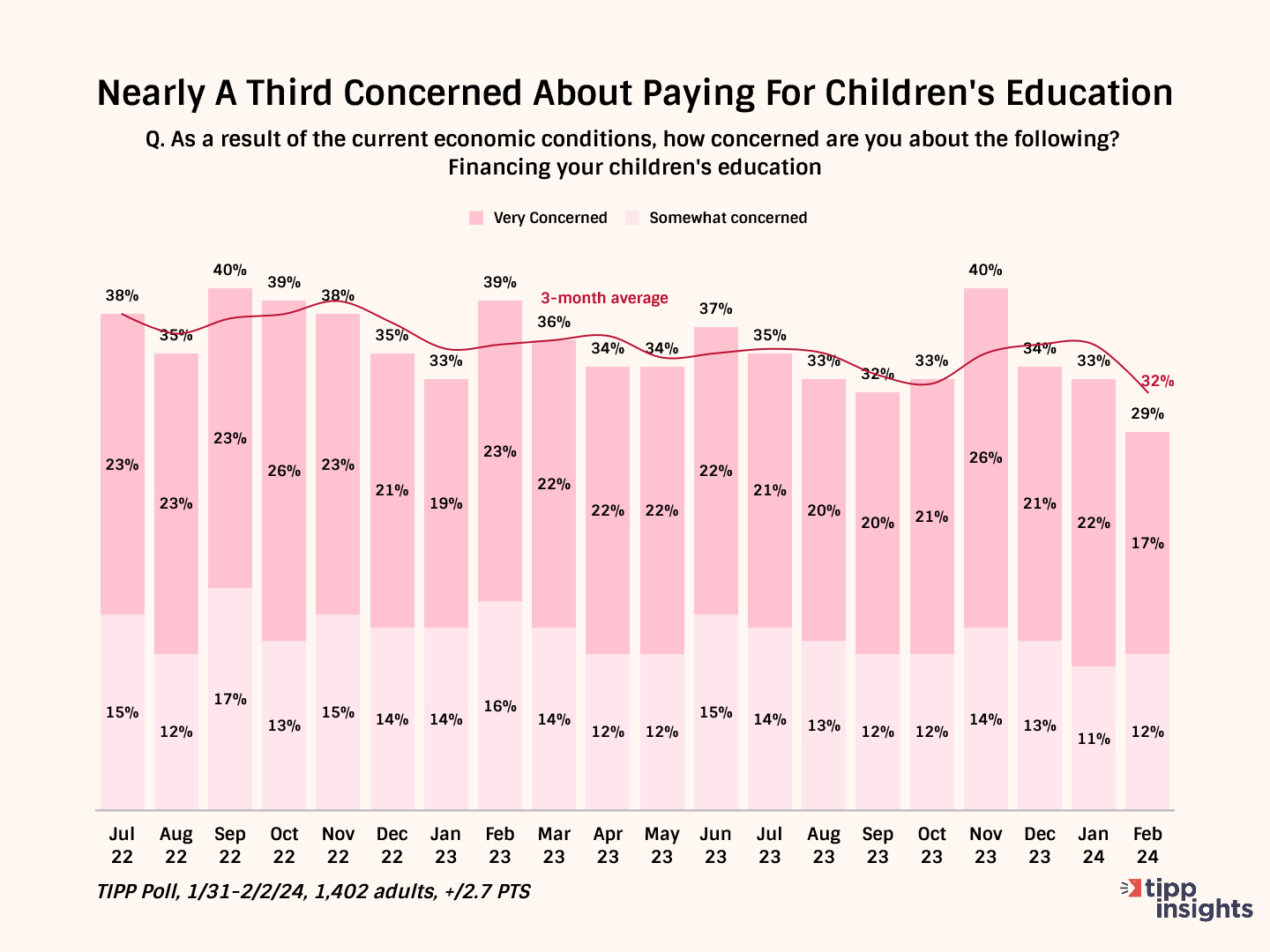

Children’s Education

Over one-quarter (29%) are concerned about financing children’s education. One in six (17%) is very concerned, and 12% are somewhat concerned. The item did not apply to 56% of those who participated in the survey.

Concern levels are similar for Democrats (32%), Republicans (30%), and independents (24%).

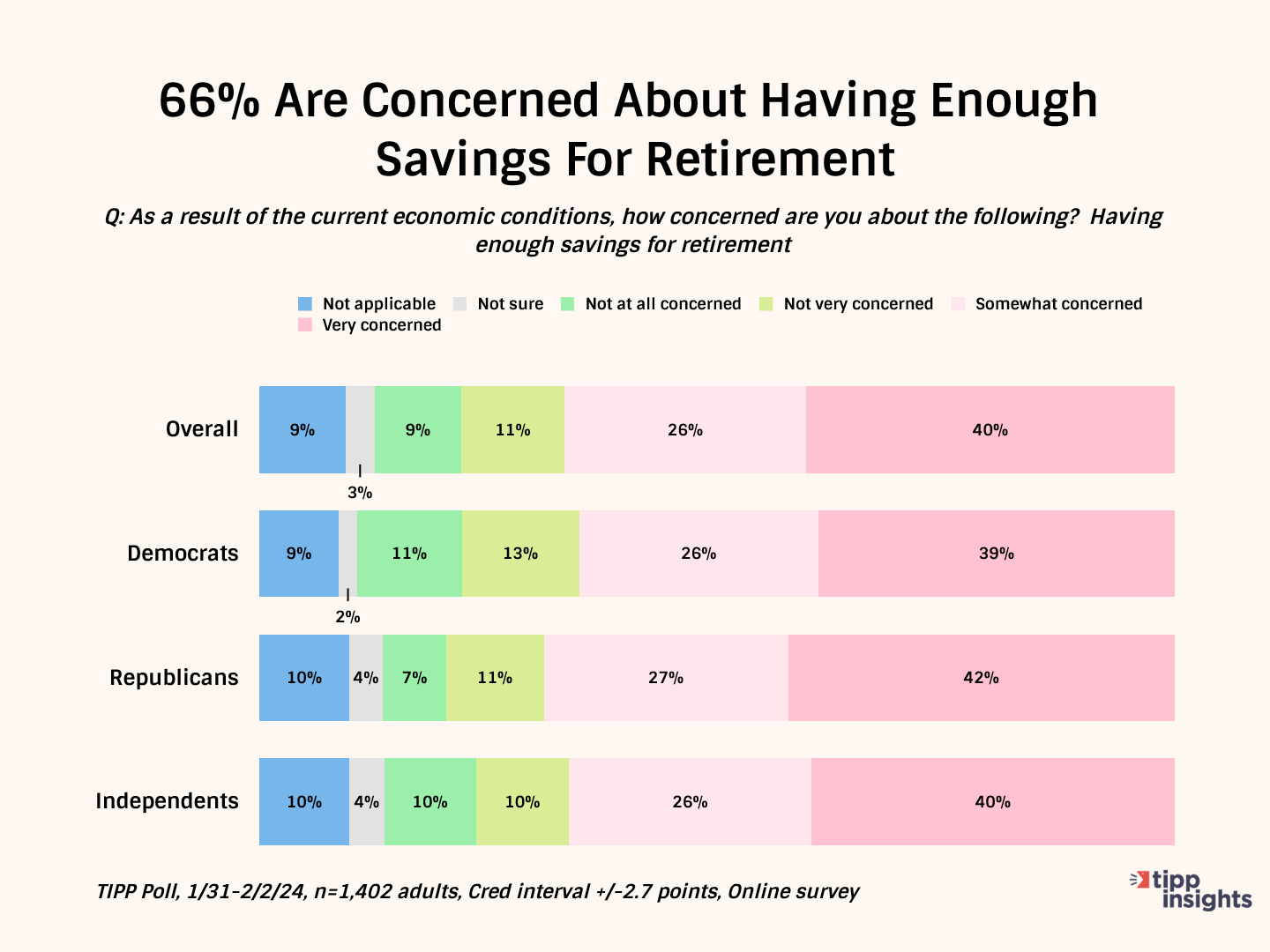

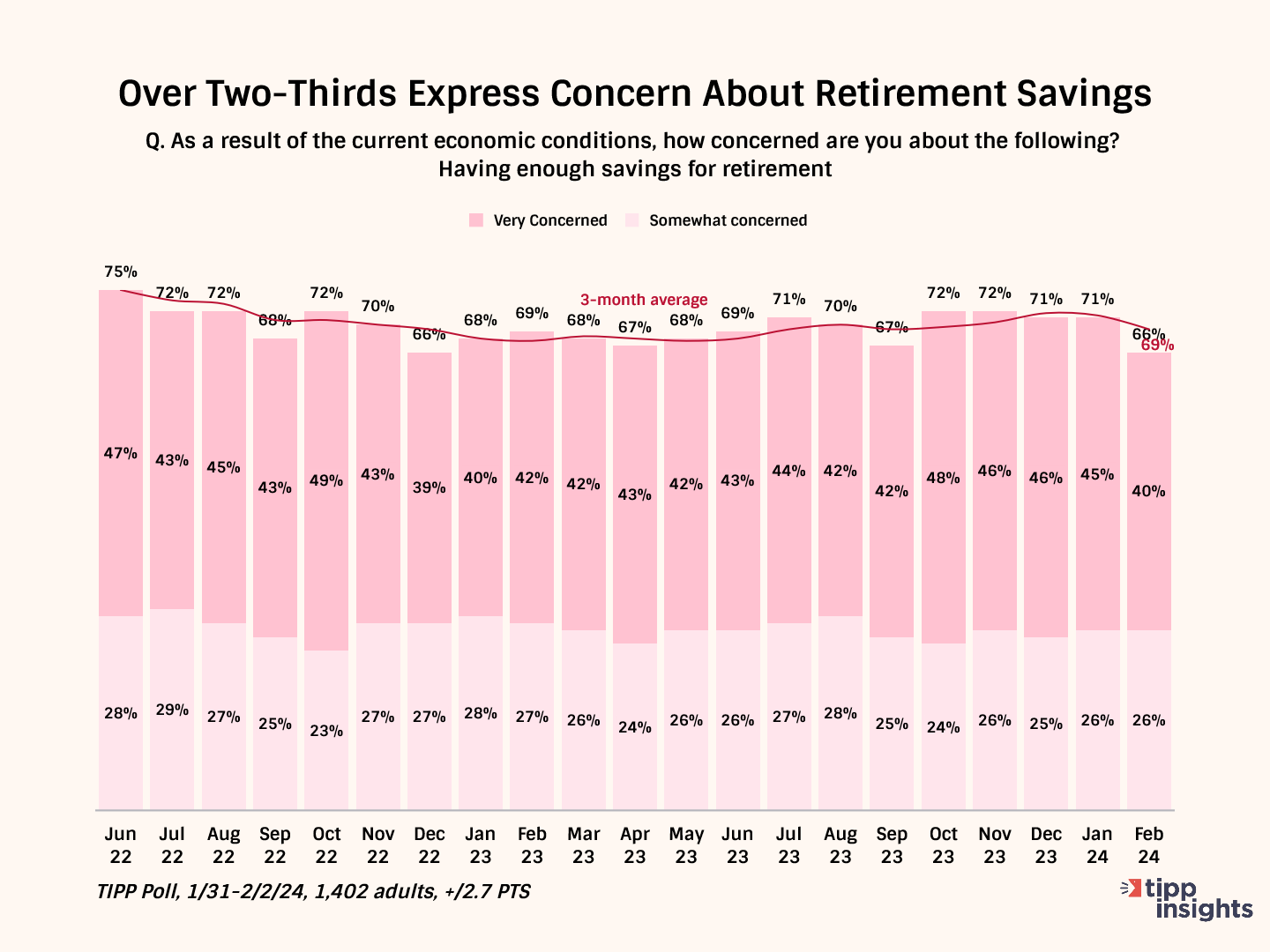

Retirement Savings

Two-thirds are concerned about having enough savings for retirement. Four in ten are very concerned; another quarter (26%) is somewhat concerned.

Interestingly, the concern among those aged 65+ is the lowest:

- 64% for age 18-24

- 75% for age 25-44

- 70% for age 45-64, and

- 49% for age 65+

Tracking over the past two years shows:

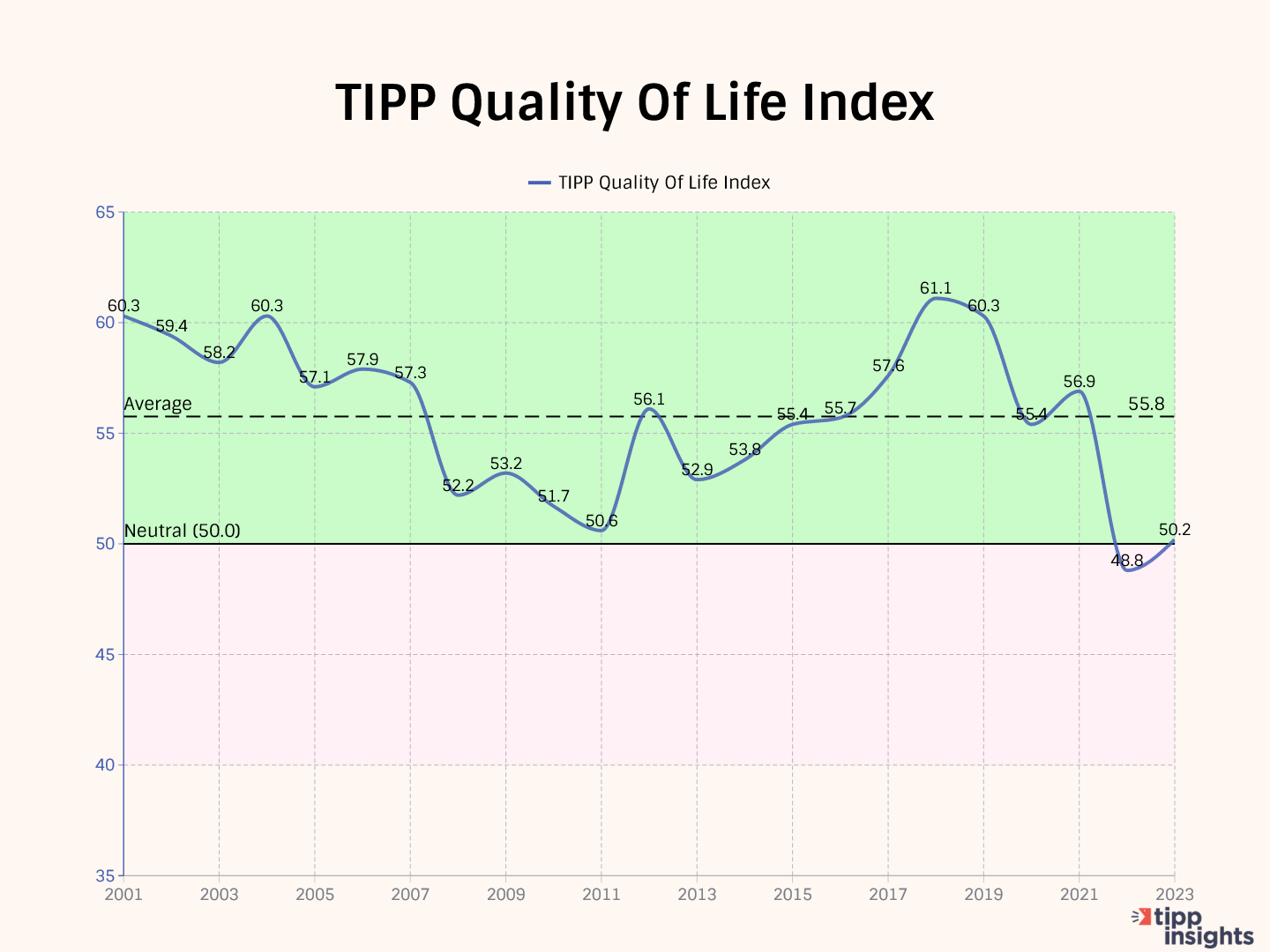

Quality Of Life Index

Each month, the TIPP Poll asks Americans the question:

In the next six months, do you think that your quality of life will be better, worse, or about the same as now?

The responses are converted to a compact index that ranges from 0 to 100. Above 50 is positive, below 50 is negative, and 50 is neutral.

The chart below shows the yearly averages from 2001 to 2023. Observe the average for the period, which is 55.8. Before the pandemic, the 2019 average was 60.3.

However, the quality of life index has dropped steadily. The average for 2022 was 48.8 - the first time since 2001 the annual average dipped below 50. It is still relatively weak for 2023 at 50.2.

- 60.3 for 2019

- 55.4 for 2020

- 56.9 for 2021

- 48.8 for 2022

- 50.2 for 2023

Our broad interpretation is that the quality of life index reflects Americans’ struggles today due to inflation and economic conditions.

RCM/TIPP Financial Stress Index

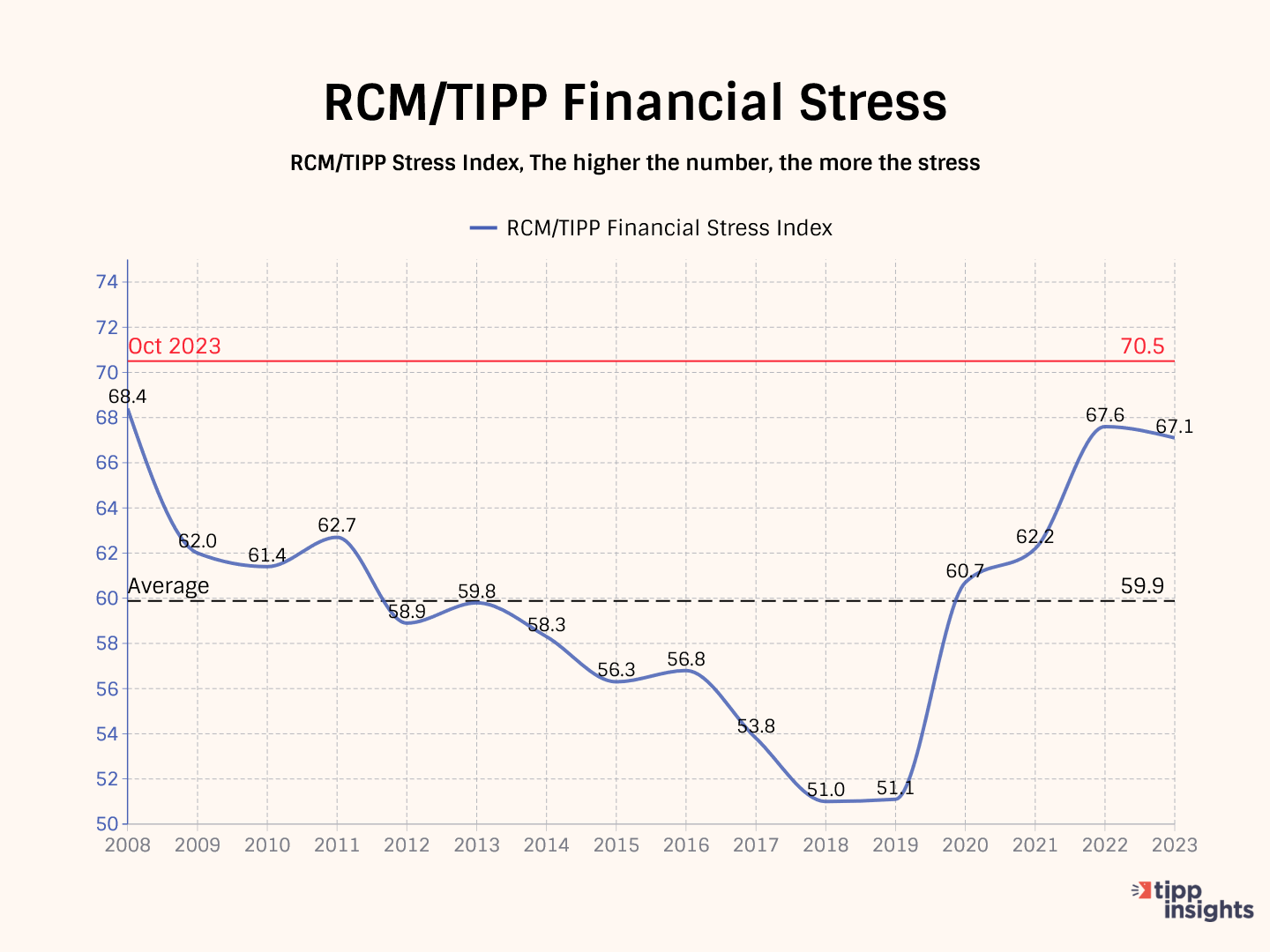

RCM/TIPP Financial Stress Index is the only metric to track the financial stress felt by Americans.

We compute the stress index from responses to the question:

Thinking of your personal finances, compared to the past three months, do you feel more stressed these days, less stressed these days, or feel the same level of stress?

The index ranges from 0 to 100; the higher the number, the more stress. A reading of 50.0 is the neutral point.

Americans’ financial struggles increase financial stress. The chart below shows the yearly average of monthly readings for each year. Notice that the levels during 2022 (67.6) and 2023 (67.5) were elevated similar to 2008 (68.4). Further, in February 2024, 32 of the 36 demographic groups we track posted 60+ on the stress index.

While we concede that unemployment is low and the economy has not yet fallen into a recession, making exaggerated claims about the broader economy to fulfill political motives is insensitive and disingenuous. People can see right through it, and the claims sound hollow. Americans expect better from economists like Krugman.

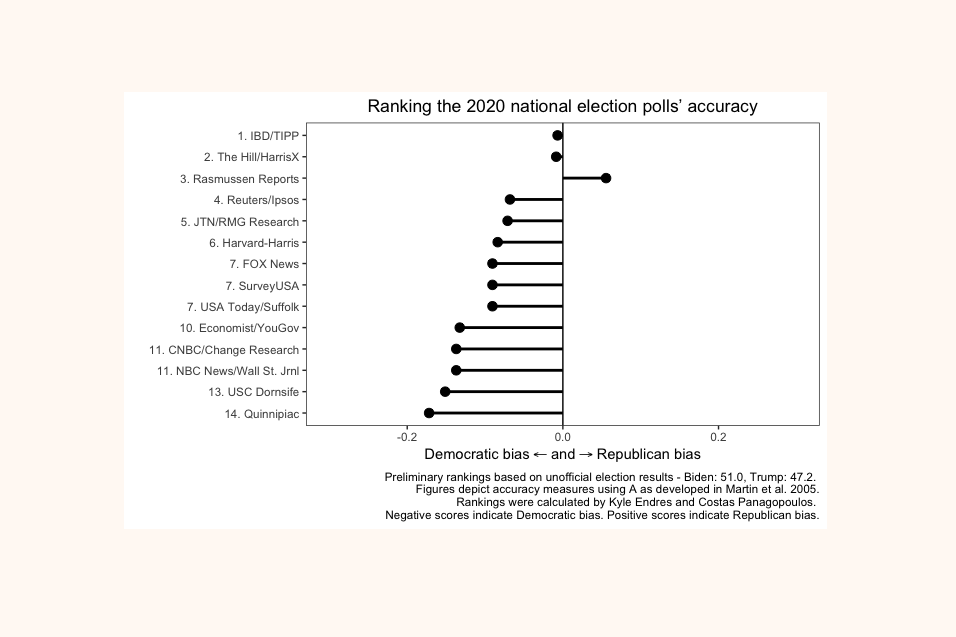

Our performance in 2020 for accuracy as rated by Washington Post: